Bookkeeping

Bookkeeping  Taxes

TaxesSystem Data  Bookkeeping

Bookkeeping  Taxes

Taxes

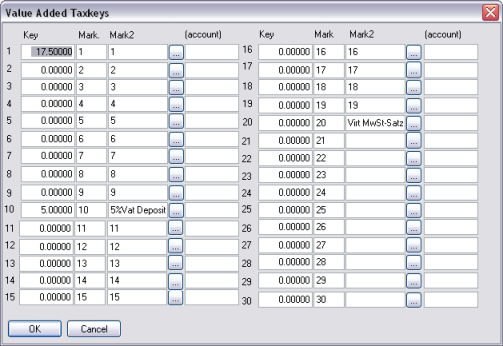

In this dialogue box you can create several value added tax keys. You may create up to 30 keys.

It is recommended to define the most used key as “1”. The assignment with regards to the transaction accounts gets easier this way.

In the first column, define the percentage key and apply a mark. for the internal use. The "mark2" includes the text that is printed on reports and invoices.

With the button you can create a language dependent text.

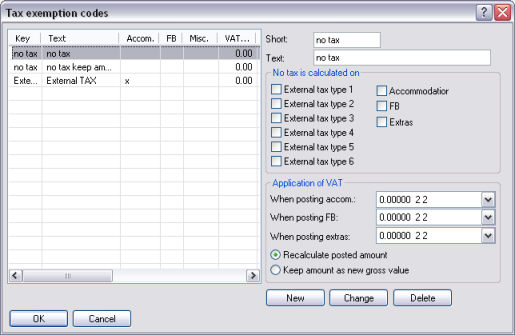

Each guest can be assigned a tax exemption code in the tab “Personal Data” of the guest profile. It’s in this dialogue box that the corresponding codes are defined.

Apply an abbreviation "Short" for the tax exemption code and a name for it in the field “Text”.

Determine by tagging the checkbox for which tax the exemption should apply. On top of this you can create a different VAT key for accommodation, F&B and extras postings that can be selected from the following pick up boxes.

Add data to the list by clicking . Should you wish to edit an existing entry, highlight and modify the data and save by clicking on . The button removes a previously highlighted entry, unless this code is in use.